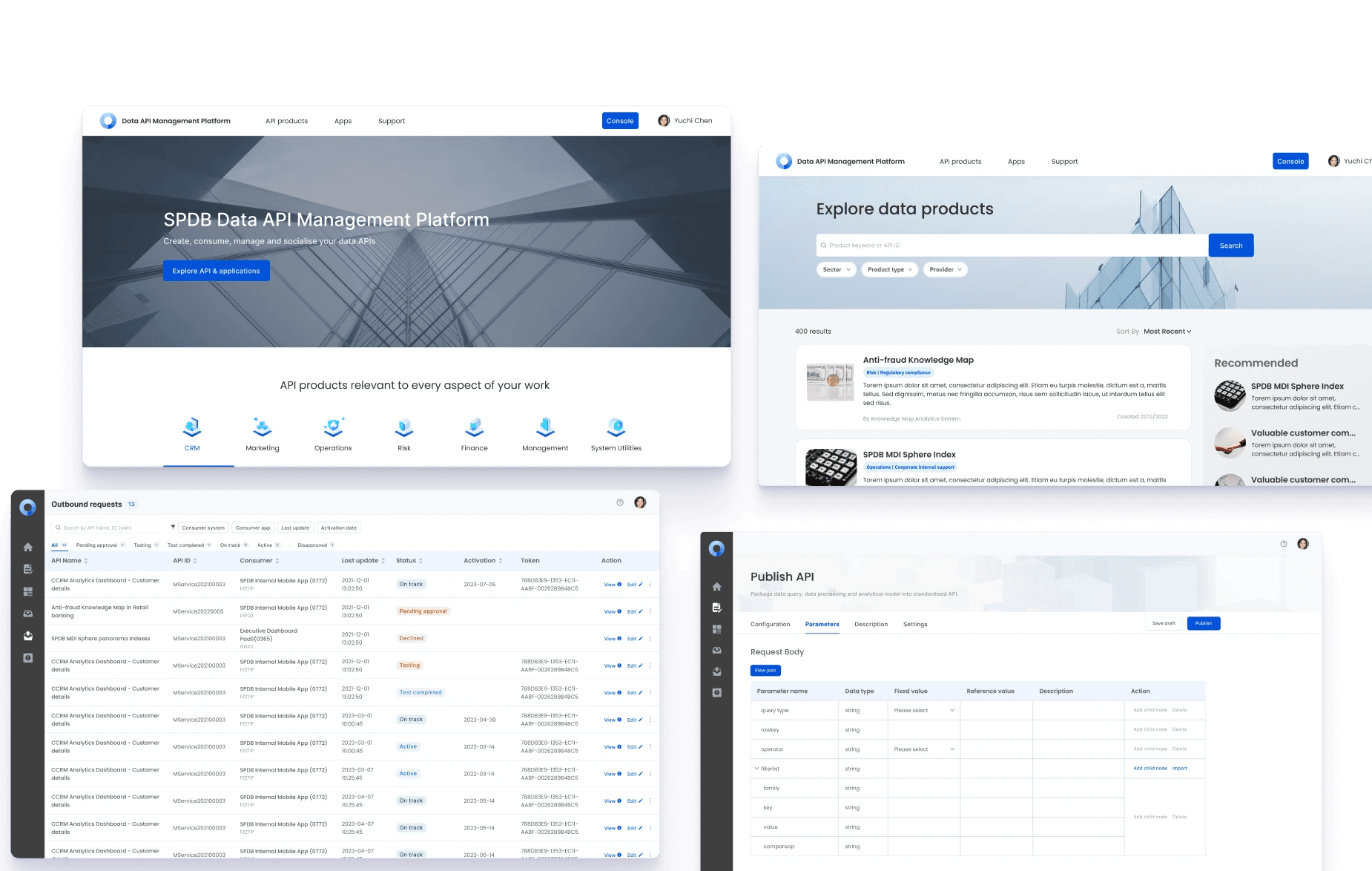

The Project

As a part of UX Bootcamp simulation project, our design team presented 3 innovative feature solutions that tackled unaddressed user needs over 4 weeks,

What I did

Background research

Wireframing

Prototyping

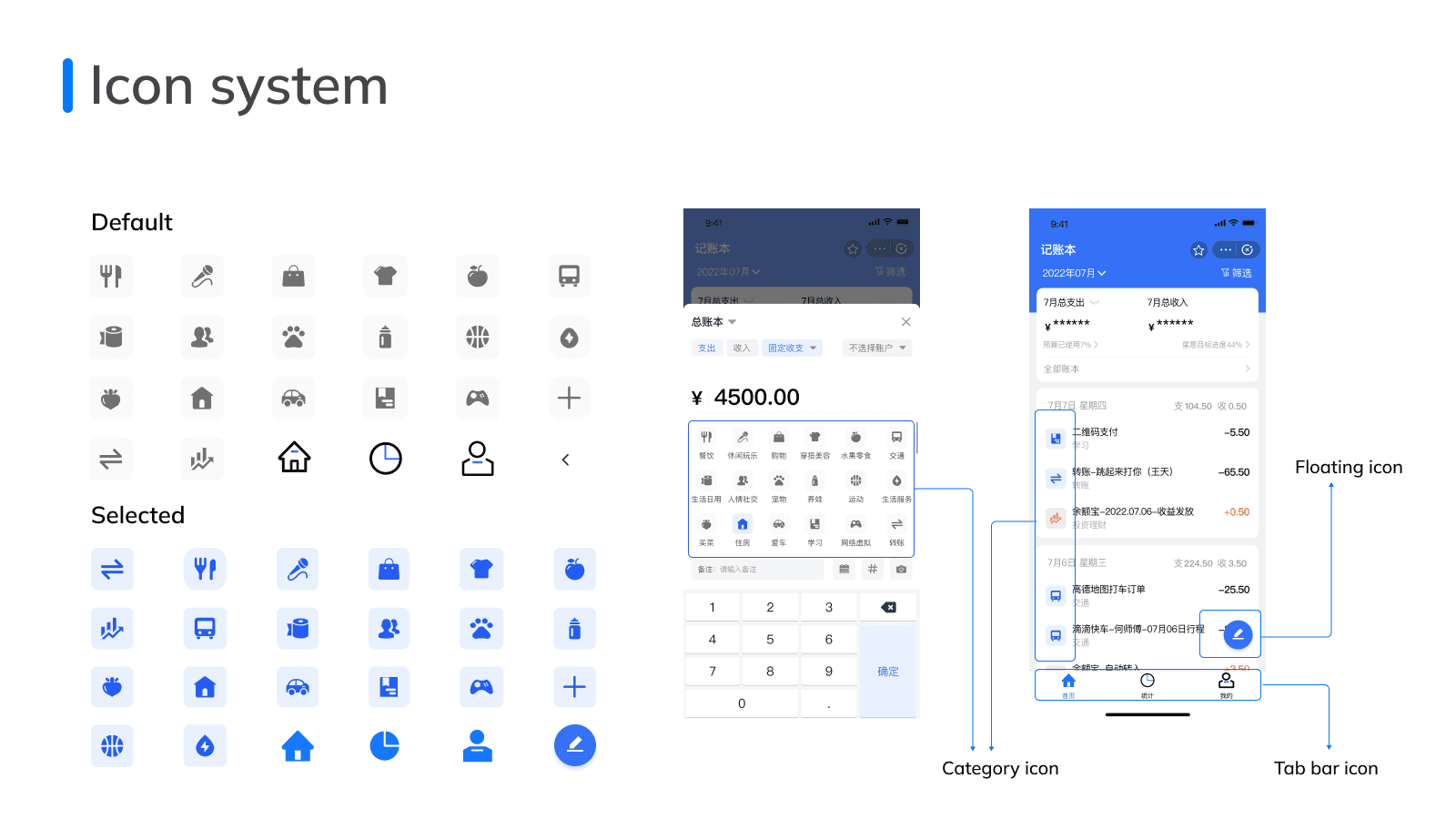

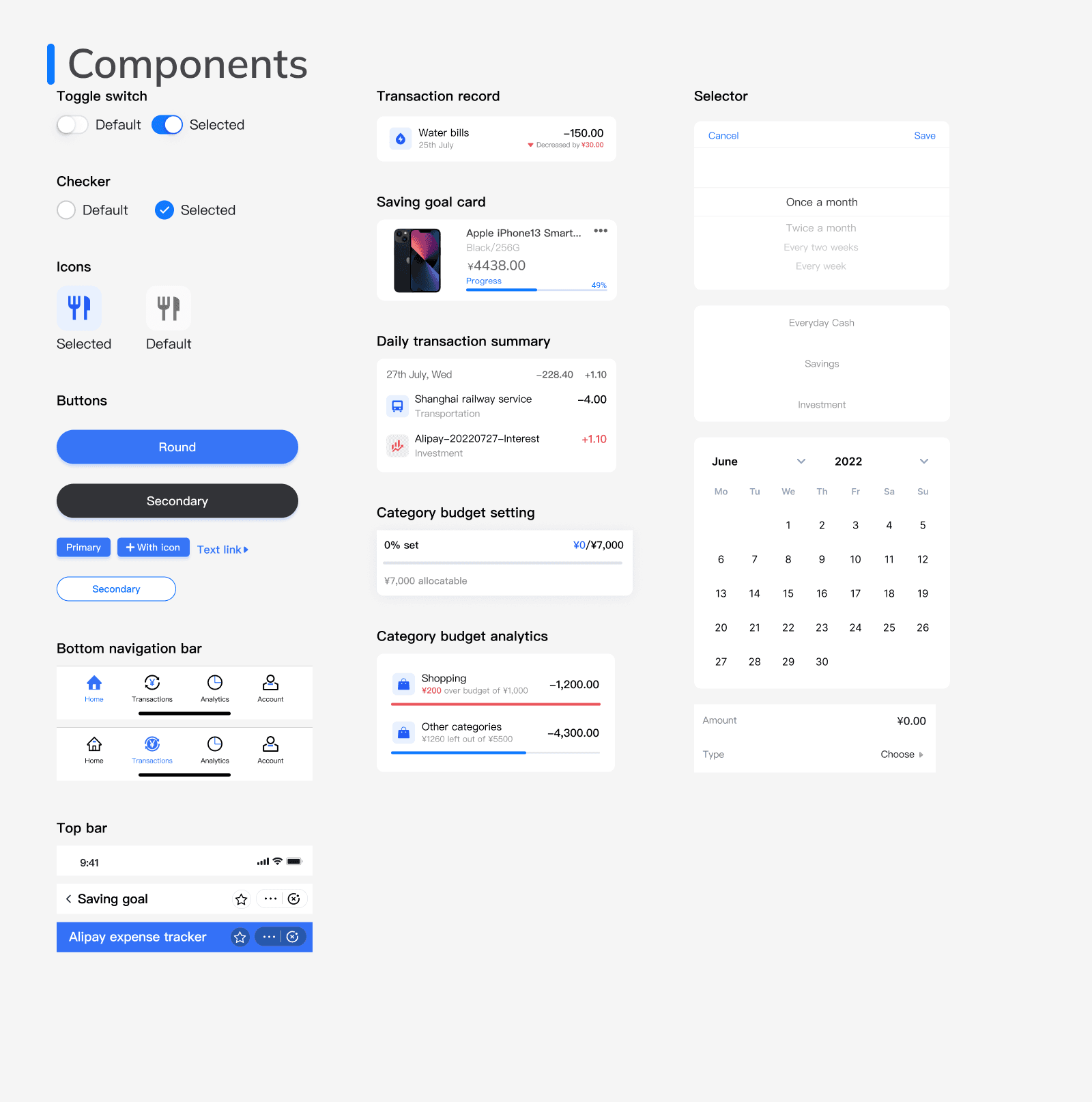

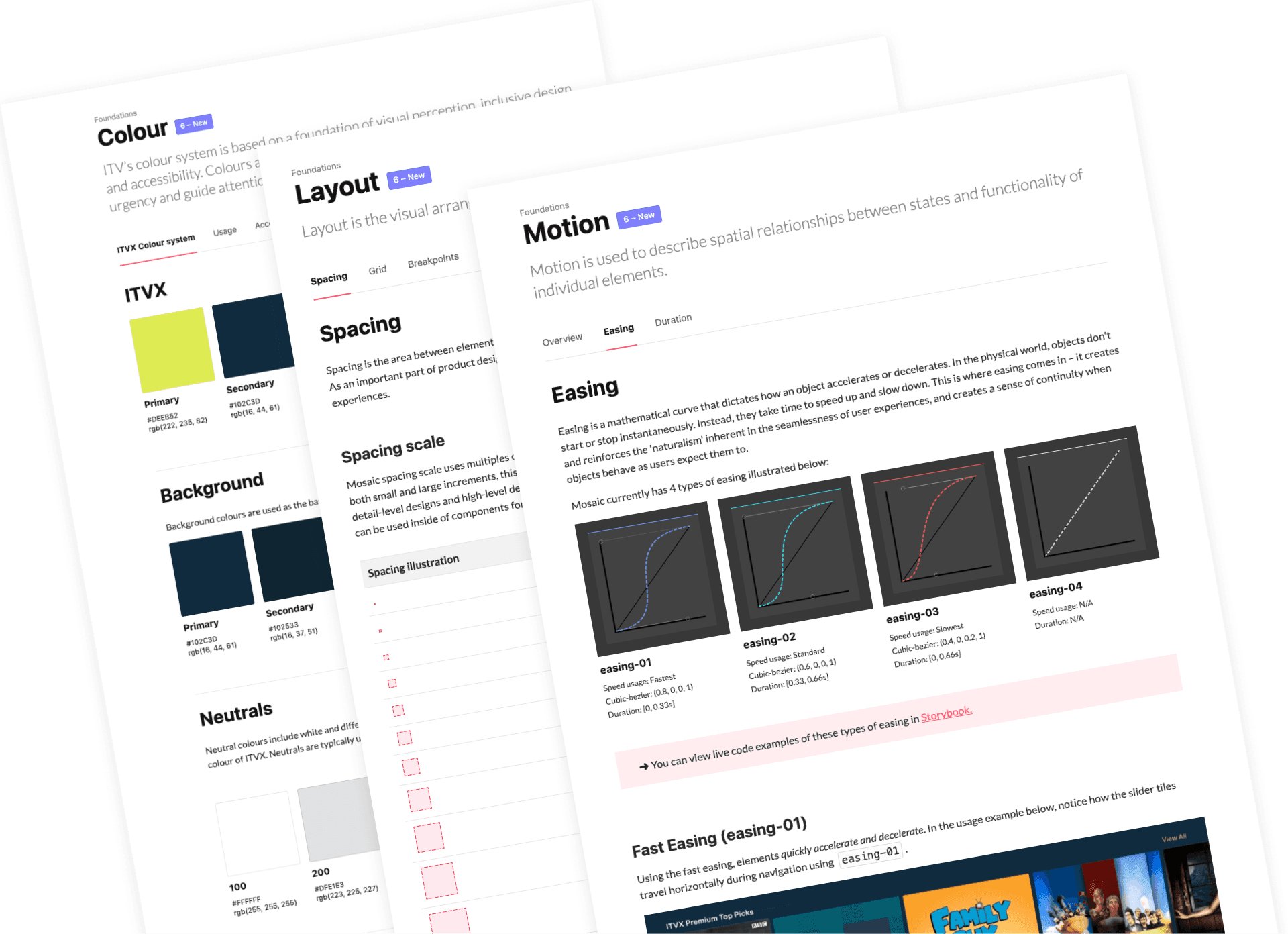

Design system

The Team

A group of 6 including fellow bootcamp attendees from diverse fields like product design, visual arts, and HMI.

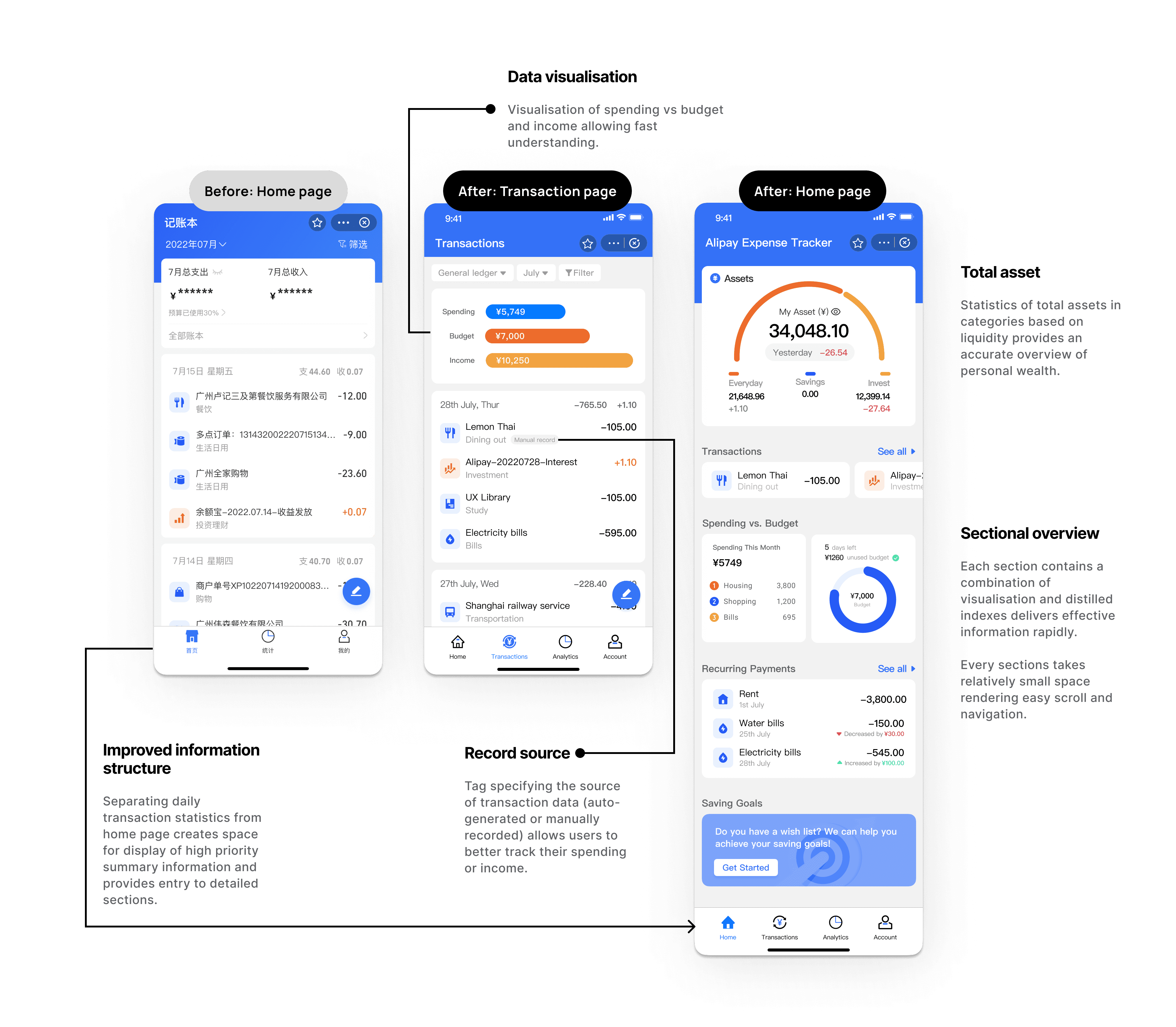

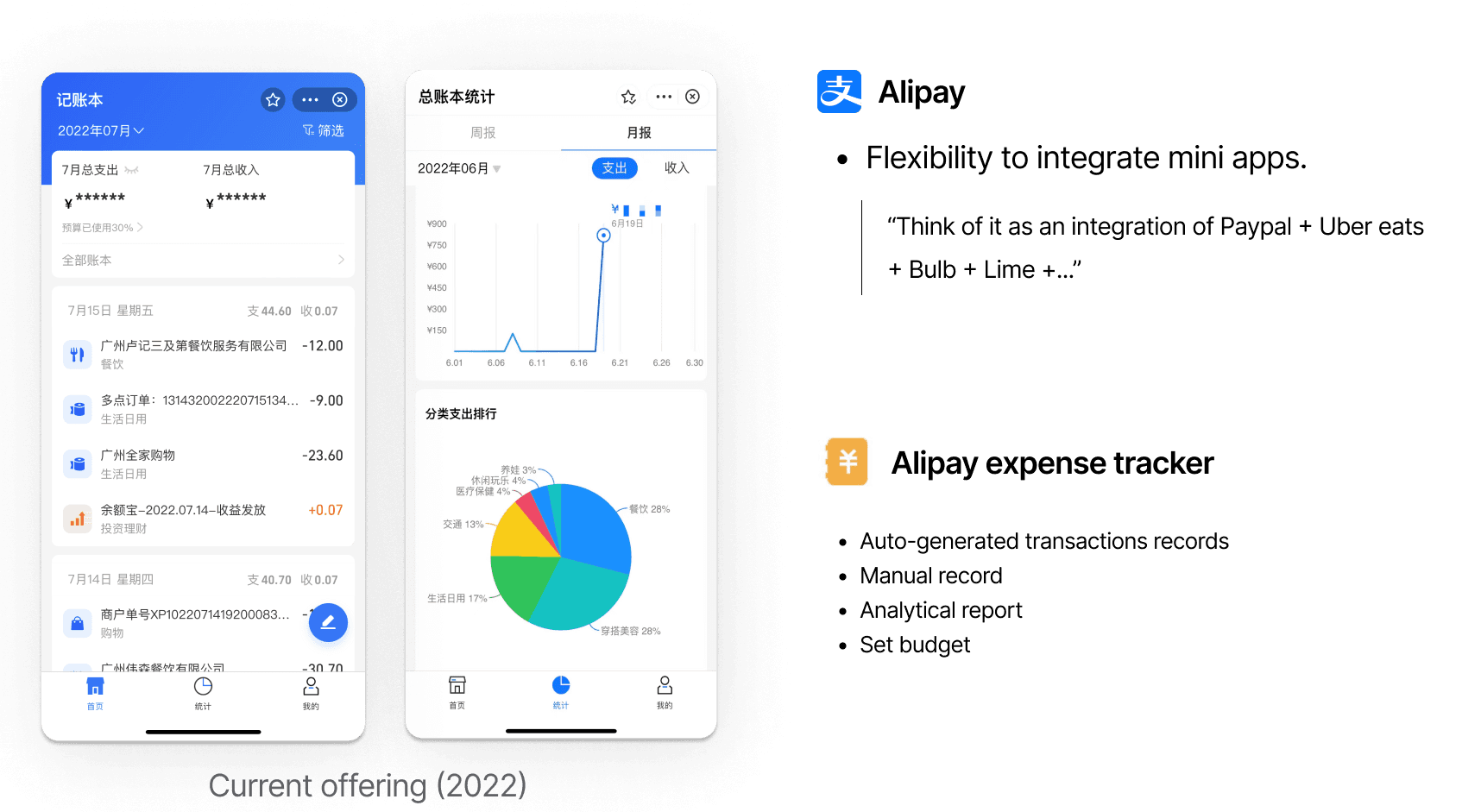

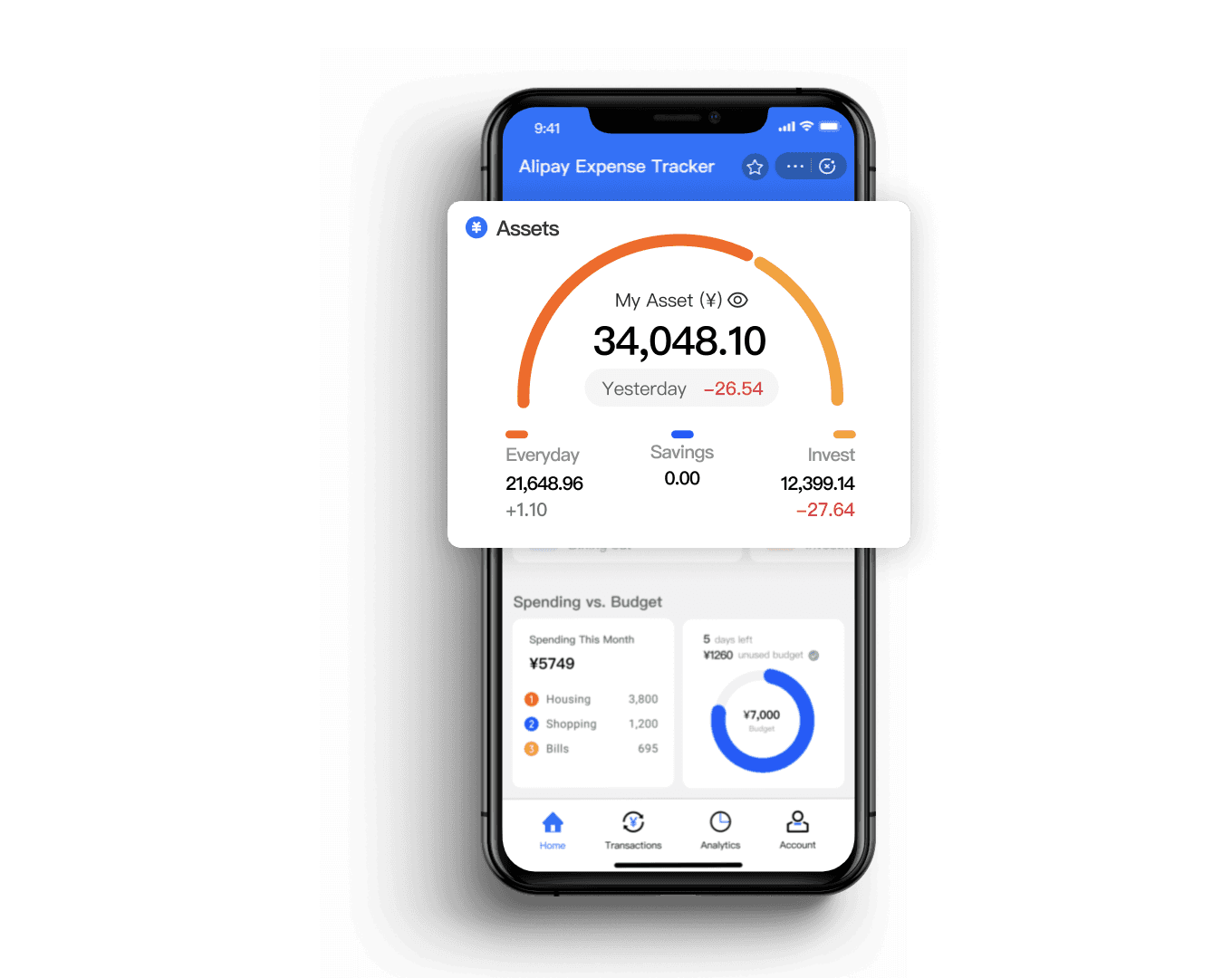

Alipay is the leading force of China's payment applications, characterised by its flexibility to integrate applets (mini apps) to expand the range of services. In China, we use Alipay to do almost everything, such paying energy bills, calling a cab, booking hospital appoints, all thanks to the integration of mini apps, equivalent to an integrated Paypal + Uber eats + Bulb ...,,. The expense tracker is Alipay's official mini app and currently allow users to track spending and monitor budget.

Current problem

54% Negative feedback

While many users appreciated the practicality and simplicity of Alipay expense tracker, the applet received a high volume of negative feedback following a major update in October 2020, comprising 54% of total reviews. Pain points evolve around the following aspects:

Missing total assets data

Limited customisation options

Insufficient data statistics

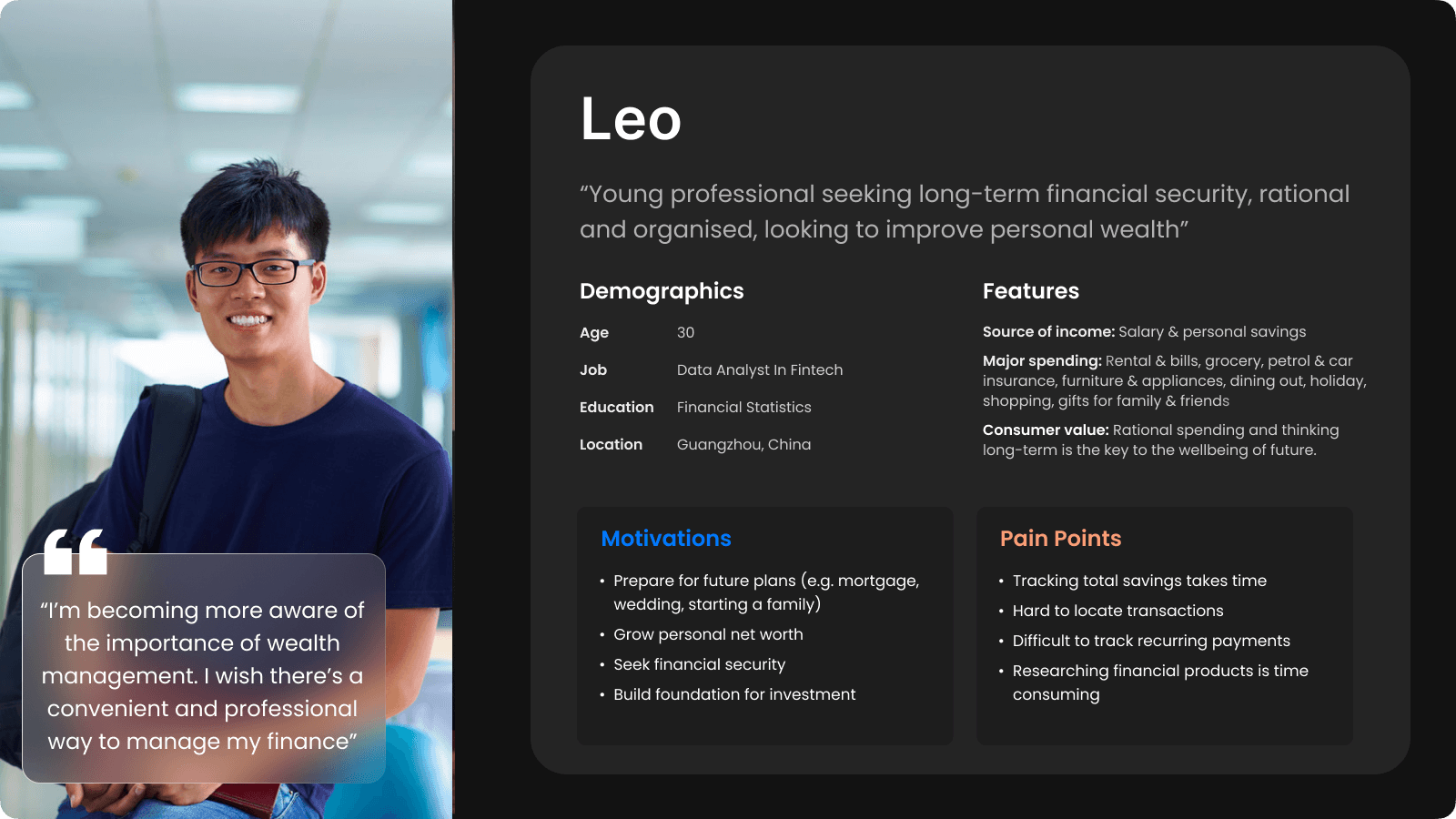

Potential target

Primary users are post-90s generations

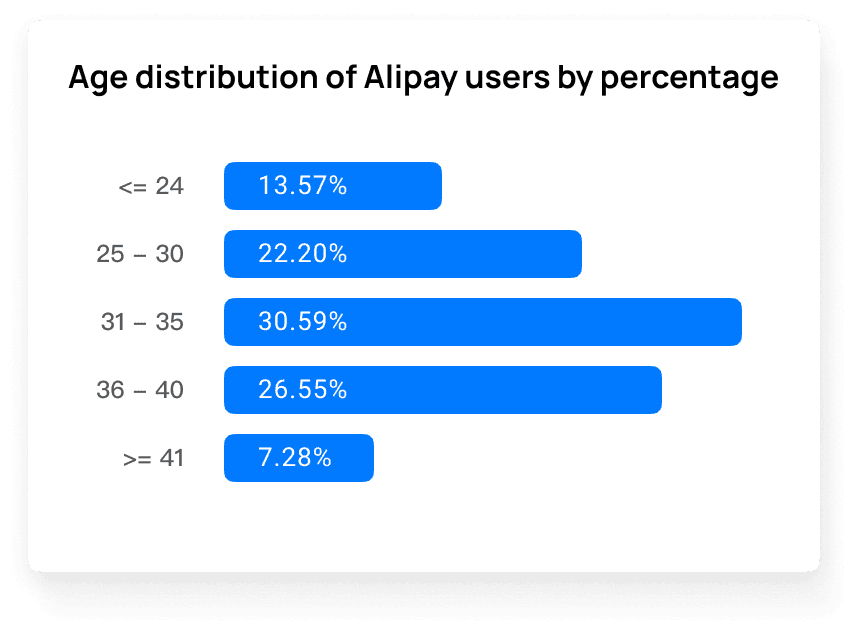

Although we possess a basic understanding of customer feedback, we want to find our dominant user segments to guarantee a more extensive representation.

Analytics reports show that Individuals under 35 years old represent the majority of Alipay's users, accounting for 68.16% of the total.

This demographic cohort is typically referred to as the post-90s generations in China, characterised by strong affinity to information technology, as well as increasing sense of individualism and realism.

User psychology

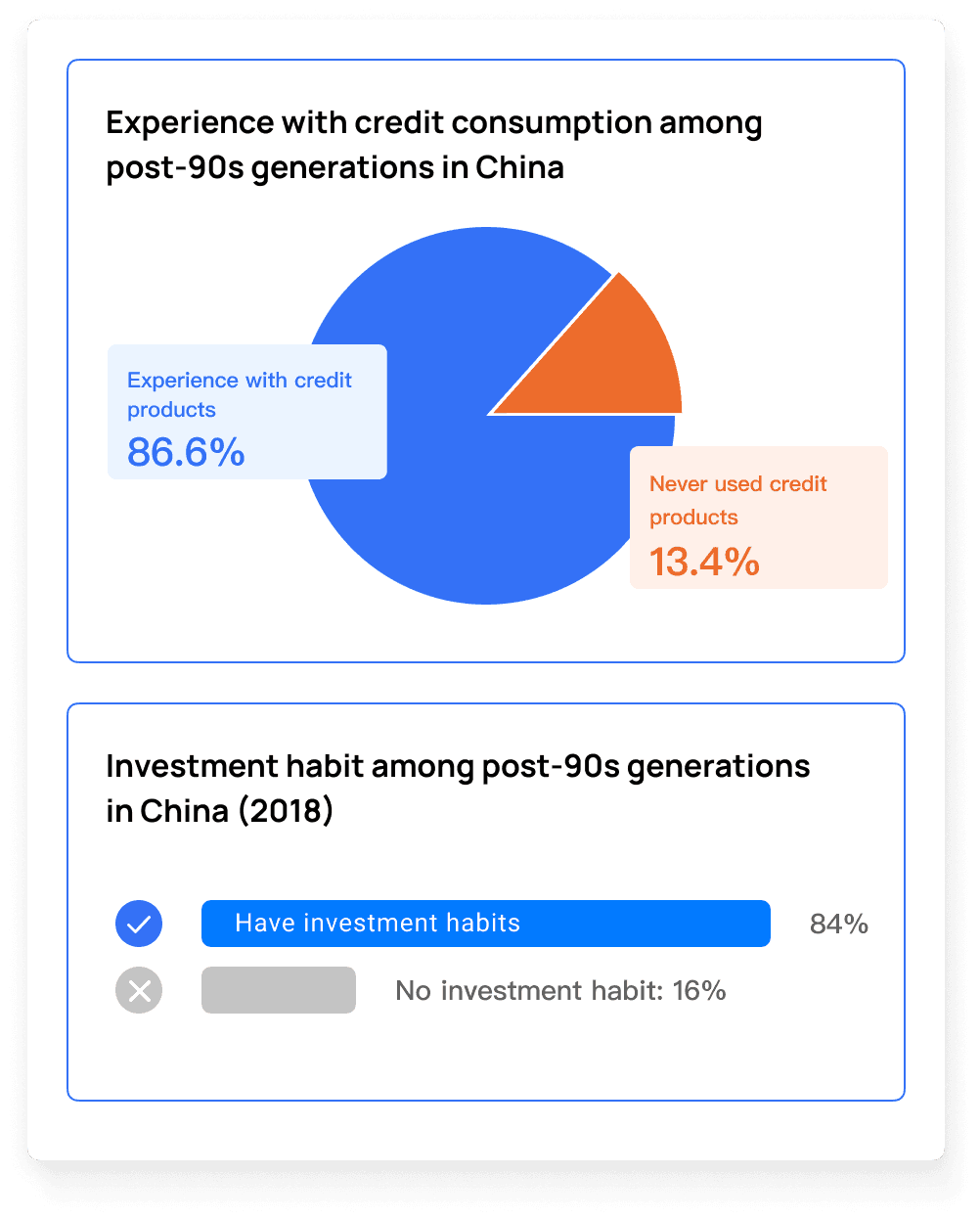

Increasing awareness of personal wealth management

While credit consumption has become the new norm for post-90s generations, most are increasingly conscious of personal wealth management, leading to a growing demand for convenient and automated finance management tools.

User behaviour

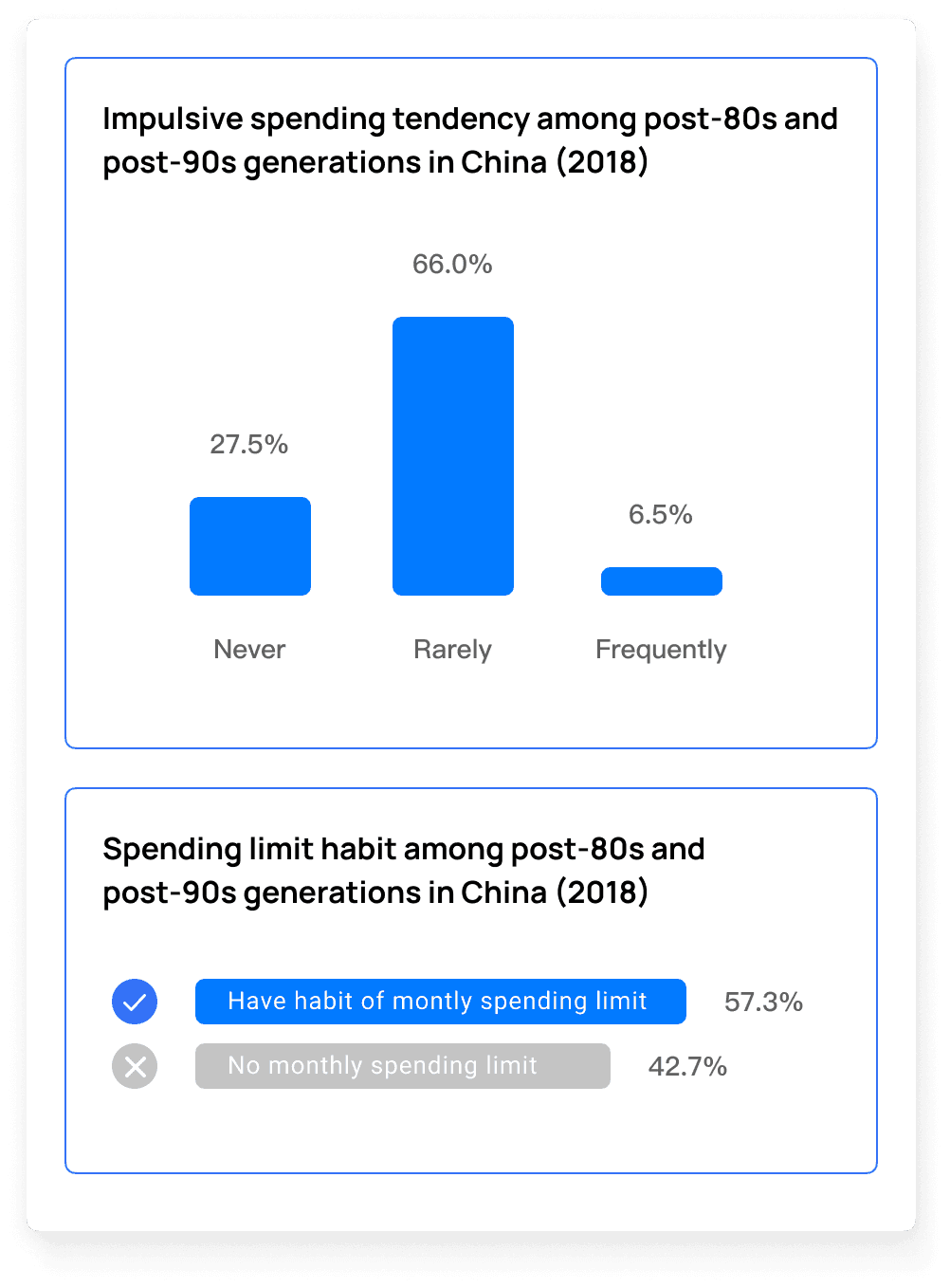

Tendency of impulsive spending & habit of budget control

Statistics reveal that 72.5% of post-80s and post-90s cohorts have engaged in impulsive purchasing, while 57.3% aim to restrict their monthly expenditures to 10%-40% of their income. Impressively, 90% succeed in keeping their impulsive spending within the budget limit. This practice of budget management effectively prevents individuals from living from pay check to pay check.

Post-90s generations in China exhibit the psychological and behavioural variables that could potentially benefit from Alipay expense tracker.

In return, this applet could act as a portal for enticing clients for Alipay's expanding financial products and services.

Our goal of this design is to help post-90s generation in China better shape the habit of expense monitoring and budget control.

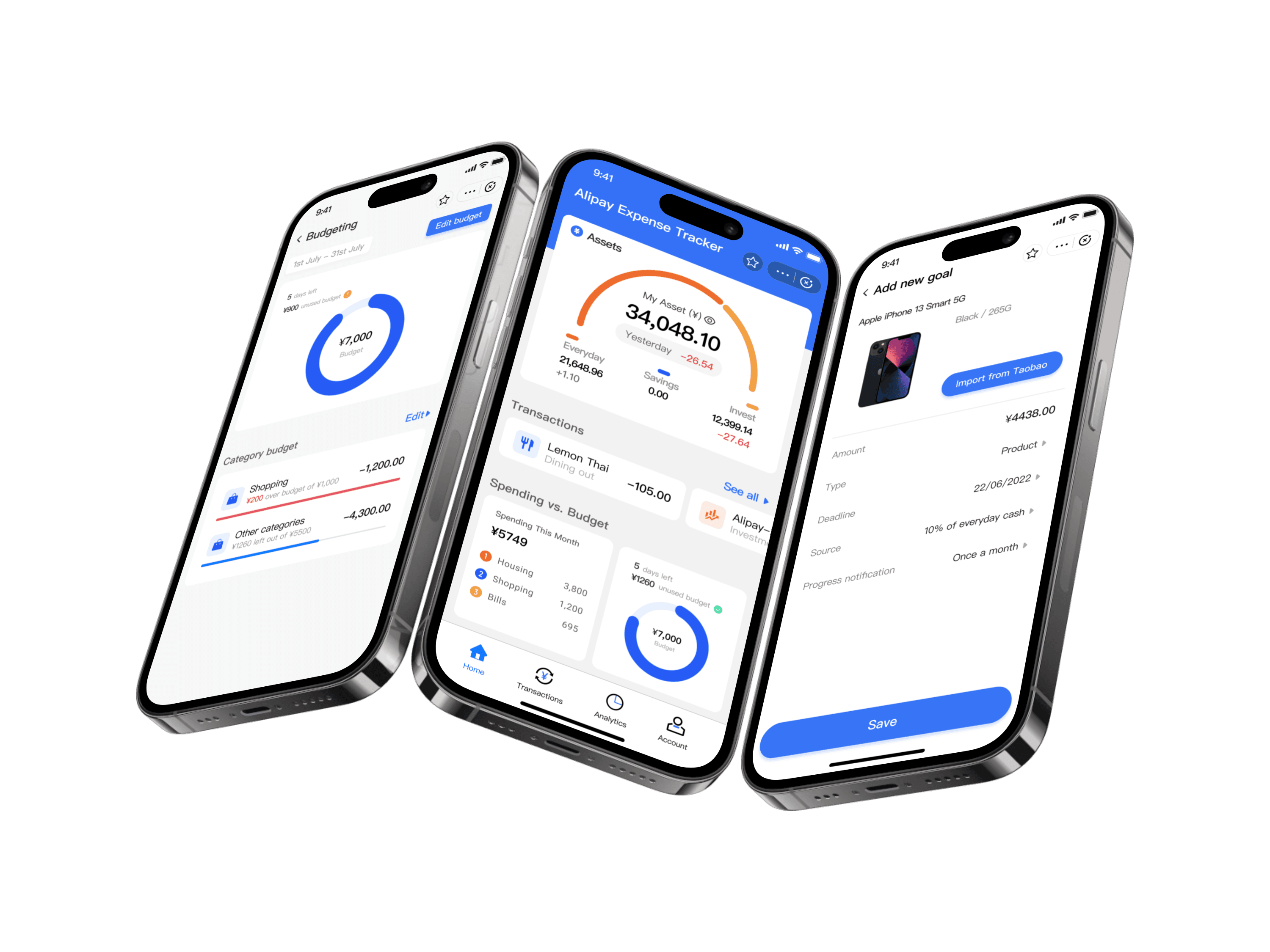

Solution 1: Set goals

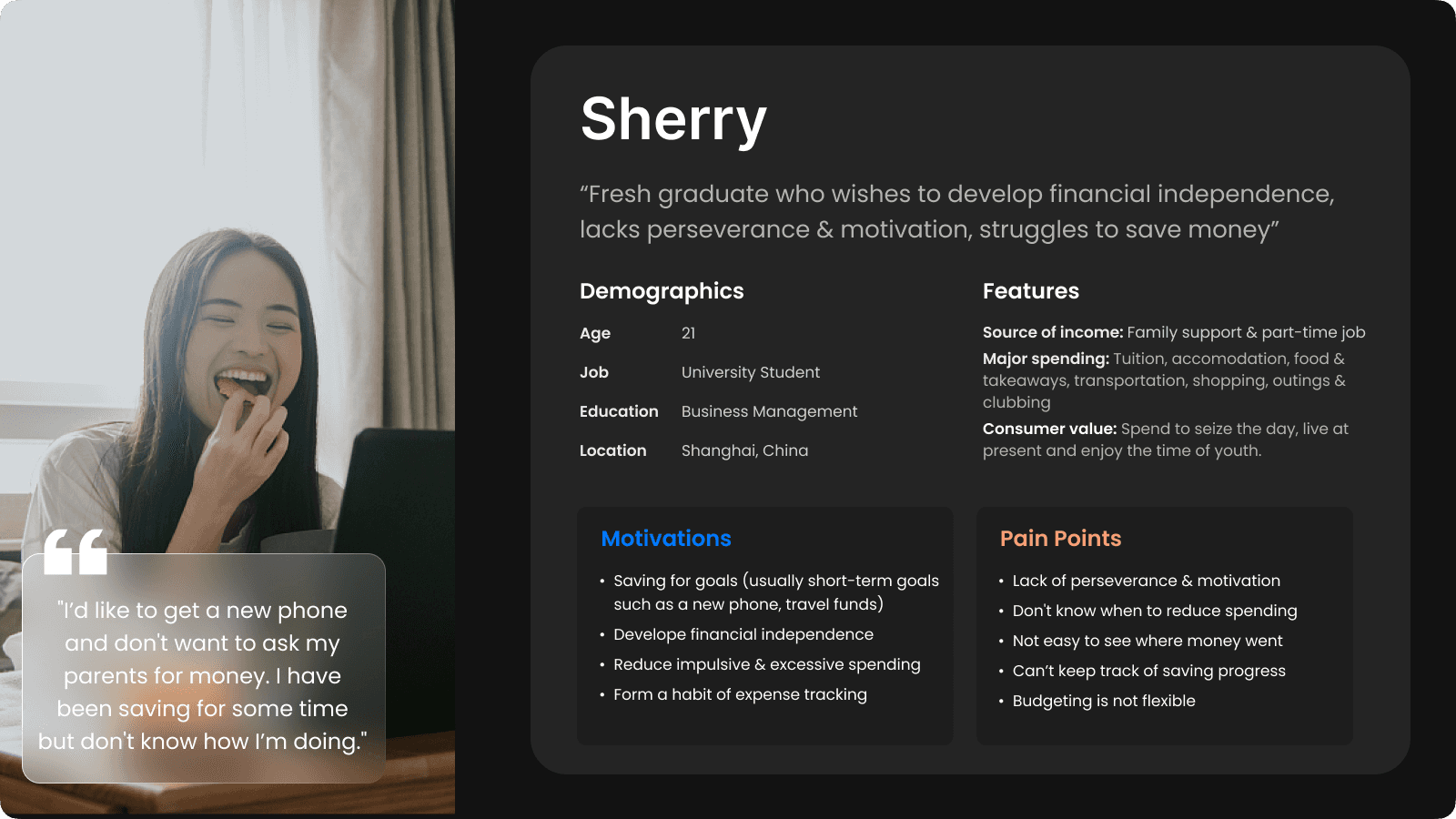

First and foremost, through user interviews, we discovered that most users have this habit of "setting goals."For someone like Sherry, it's about getting her hands on those fantastic items she fancies.

However, the existing competition out there falls short. They require users to manually enter their goals, unable to keep up with real-time price fluctuations or dynamically adjust the daily savings needed.

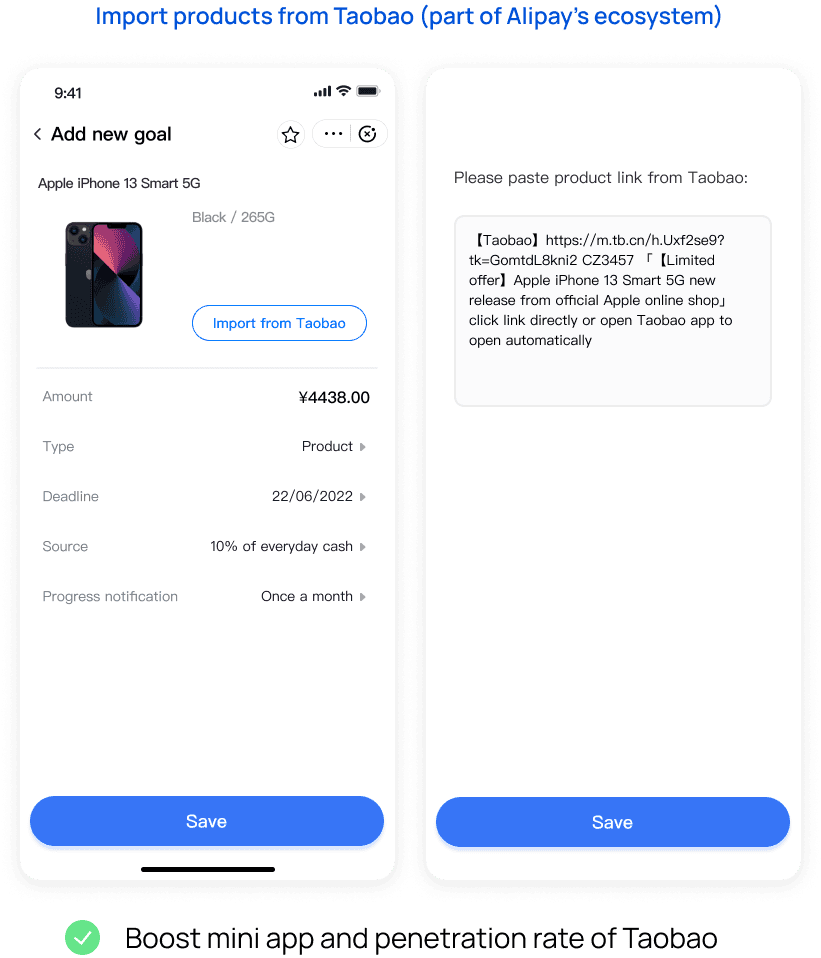

Custom goal setting allowing quick link import from Taobao

Here's where our product comes into play, nestled comfortably within Alipay. We enable users to import product details from taobao, a shopping app under Ali group. The fact that Alipay and Taobao are part of the same ecosystem gives us a unique advantage, leading to a win-win scenario: boosting both the expend tracker mini app and the penetration rate of Taobao.

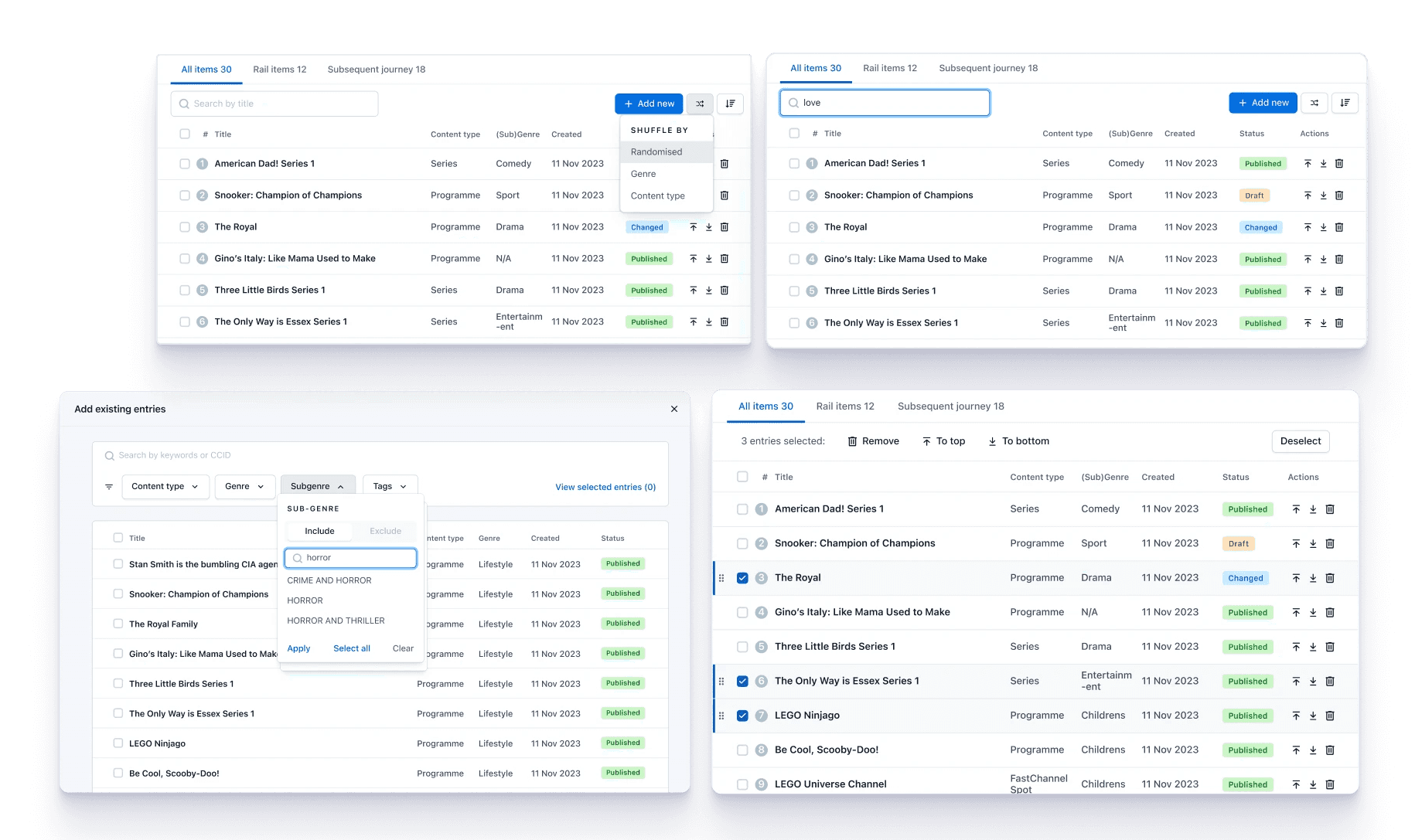

Solution 2: Category budget

The second design solution for Sherry is category budget.

This feature allows Sherry to set up budget towards a particular category, such as shopping, she can check usage of budget cycle and receive warning notifications.

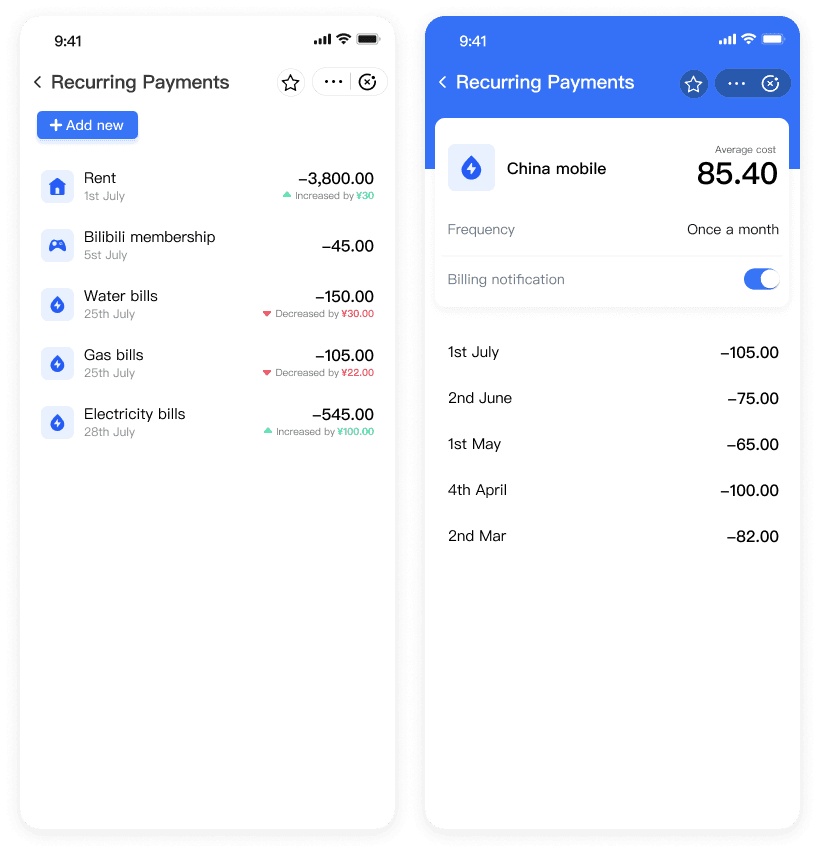

Solution 1: Manage recurring payments

Leo has multiple recurring payments such as energy bills, mobile, and membership subscriptions. Sometimes out-of-plan fees occur and his busy schedule obstructs him from taking care all the bills perfectly, he receives reminders of bills payments frequently.

We enable him to stay focused on what truly matters, namely, developing his career goals, researching financial investments, and take away the hassle of tracking every little expense.

Mark recurring payments, customise billing period and view periodic changes

On Alipay expense tracker, he can see the changes of recurring payments, mark payments as recurrent and edit the billing period and notifications. This way, he will be able to manage recurring payments and better prepare cash flow for future billing.

Solution 2: Track total savings

Leo is more focused on growth of net worth, and more likely to engage in investments, It is important for him to track his total savings so that he can get a better understanding of his financial capability.

The Alipay expense tracker enables him to track his total assets, the assets are categorised by liquidity, namely, everyday cash, savings and investments, with daily fluctuations of each category of the asset.